Finace

Take Leverage Meaning Finance: A Comprehensive Guide to Leveraged Finance

Understanding the World of Leveraged Finance

Leveraged finance, also known as LevFin, is a critical aspect of corporate finance that involves financing highly leveraged companies with a speculative-grade credit rating. It plays a crucial role in various corporate transactions, including leveraged buyouts, mergers and acquisitions, debt refinancing, and recapitalizations.

This comprehensive guide will delve into the intricacies of leveraged finance, exploring its key components, key players, and various debt structures used within this field.

Investment-Grade vs. Speculative-Grade Debt: The Core Distinction

The world of debt financing is broadly divided into two categories:

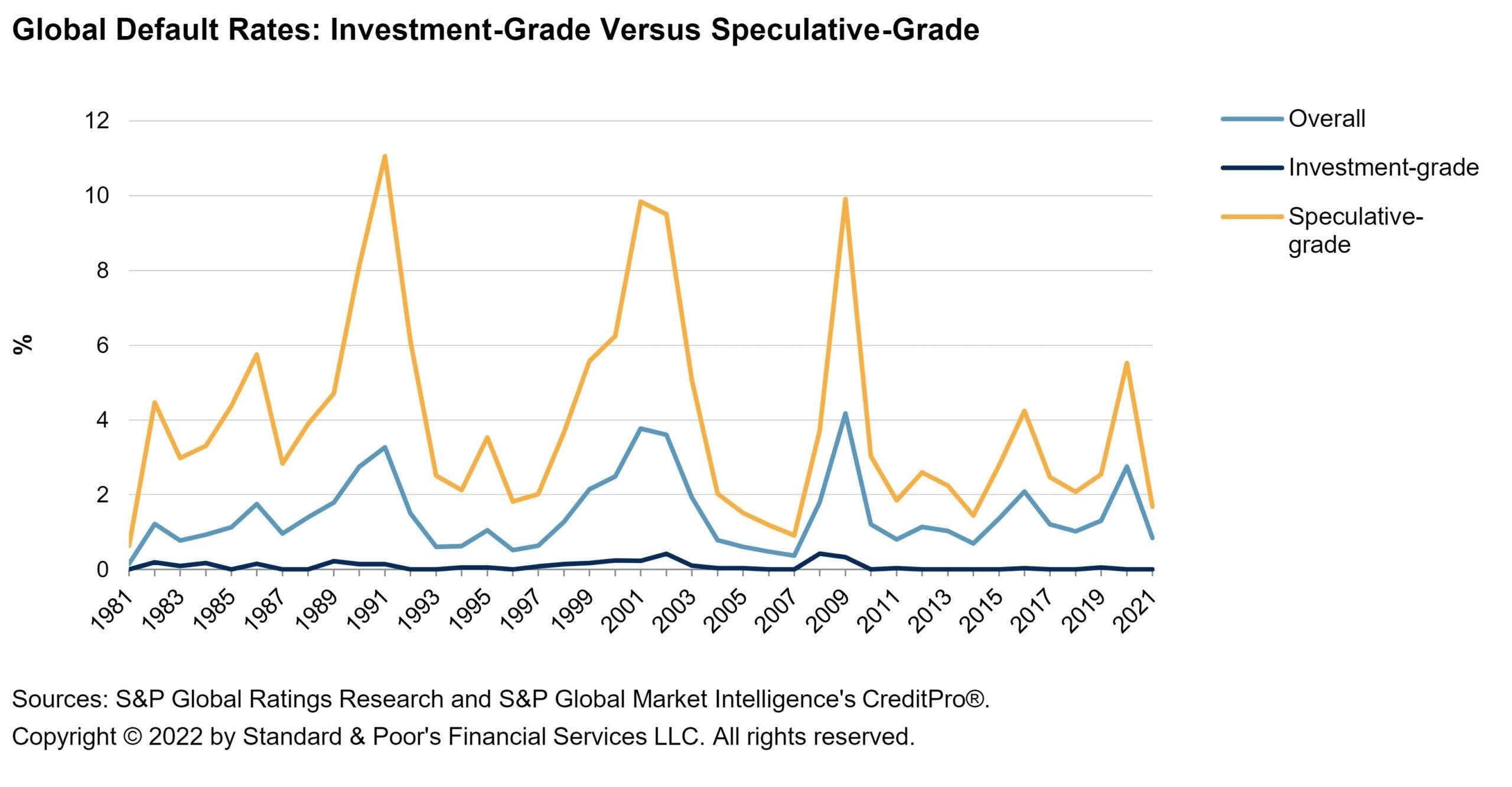

- Investment-grade debt (BBB/Baa or above): Debt issued by companies with a robust credit profile and low default risk. These companies generally have lower leverage and higher interest coverage.

- Speculative-grade debt (BB/Ba or below): Debt issued by highly leveraged companies with a riskier credit profile. This is where leveraged finance comes into play.

Both categories can access two distinct debt structures:

- Loans: Term loans and revolvers issued privately by banks and institutional investors. In the speculative-grade market, these are called leveraged loans.

- Bonds: Fixed-coupon securities publicly registered with the SEC and traded by institutional investors. Speculative-grade bonds are known as junk or high-yield bonds.

Understanding Investment-Grade Debt

Investment-grade companies typically rely on traditional bank loans and institutional investor bond financing.

Traditional Bank Loans

Banks, through their corporate banking divisions, offer investment-grade companies low-interest term loans and revolving credit facilities (revolvers) or commercial paper. These loans often sit at the most senior position in a company’s capital structure, and their safety sometimes negates the need for collateral.

Institutional Investor Bond Financing

Bonds offer investment-grade companies fixed-coupon securities with fewer restrictions and slightly higher interest rates compared to bank loans.

Leveraged Finance: The Realm of Speculative-Grade Debt

Speculative-grade companies, with their higher leverage and risk profiles, rely on a different set of financing options within the leveraged finance realm.

Leveraged Loans: Senior Debt for Highly Leveraged Companies

Leveraged loans represent senior tranches of debt in a company’s capital structure, sitting above bonds. They typically feature:

- Principal Amortization: Regular principal payments (paydown) as part of the loan terms.

- Secured: Backed by the company’s assets, providing a level of security for lenders.

- Floating Rate: Interest rates fluctuate based on benchmarks like LIBOR (soon to be replaced by SOFR).

- Shorter Maturity: Usually structured with shorter maturities compared to bonds.

- Restrictive Covenants: Include stricter terms and conditions to protect lenders.

- Private Investments: Not subject to SEC registration.

- Prepayment Flexibility: Borrowers can typically prepay the loans without penalty.

Who Invests in Leveraged Loans?

Institutional investors, including hedge funds, CLOs, mutual funds, and insurance companies, have become the dominant players in the leveraged loan market.

Senior Secured Leveraged Loans: The Importance of Collateral

Due to the higher risk associated with highly leveraged companies, senior tranches of debt (leveraged loans) typically require collateral to secure the loan. This collateral acts as a safety net for lenders in case of bankruptcy.

“Covenant Lite” Leveraged Loans: A Shift Toward Looser Lending Standards

In recent years, the leveraged loan market has witnessed a trend towards more lenient lending practices. “Covenant-lite” loans, while secured with first liens, feature less restrictive covenants. This flexibility has made leveraged loans increasingly attractive to borrowers.

Second Lien Leveraged Loans: A Higher Risk Proposition

Second lien loans are less common and riskier than first lien loans. They rank below first lien loans in the capital structure, relying on collateral value only after the first lien lender is fully repaid in a bankruptcy scenario.

Revolving Credit Facility (Revolver): Flexibility for Short-Term Needs

Revolving credit lines provide companies with a flexible line of credit for managing short-term working capital needs. These lines of credit can be either secured or unsecured, but in leveraged finance, they are often secured.

There are two types of revolvers:

- Asset-Based Loan (ABL): The maximum borrowing amount is tied to the value of the company’s assets, primarily accounts receivable and inventory.

- Cash Flow Revolver: The borrowing limit is based on the company’s historical cash flows.

Leveraged Loan Multiples and Market Dynamics: A Balancing Act

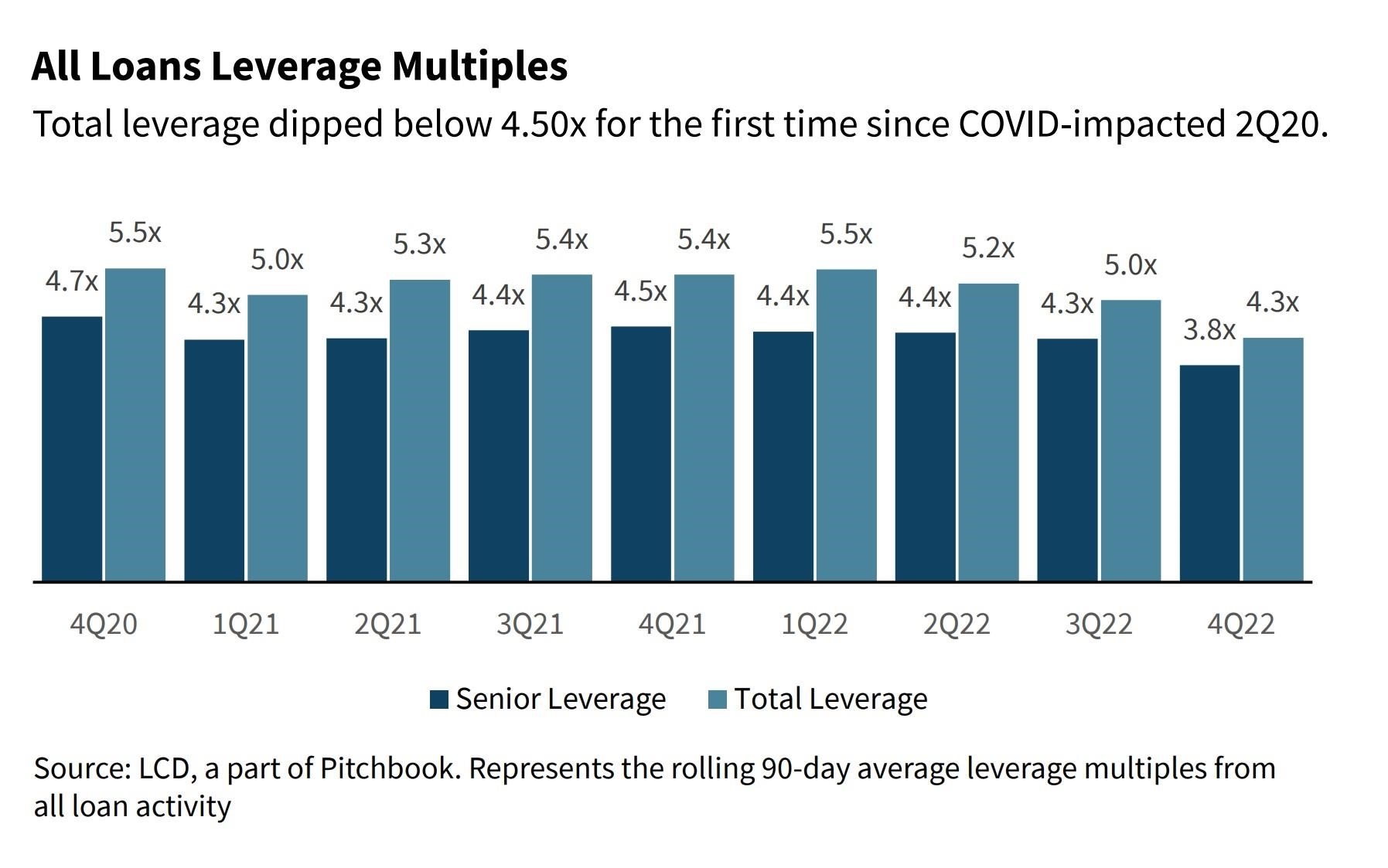

The amount of debt leveraged companies can take on is influenced by market conditions. In a borrower-friendly environment, lenders are more comfortable extending larger loans. However, during times of heightened risk aversion, the proportion of first lien loans increases to minimize risk.

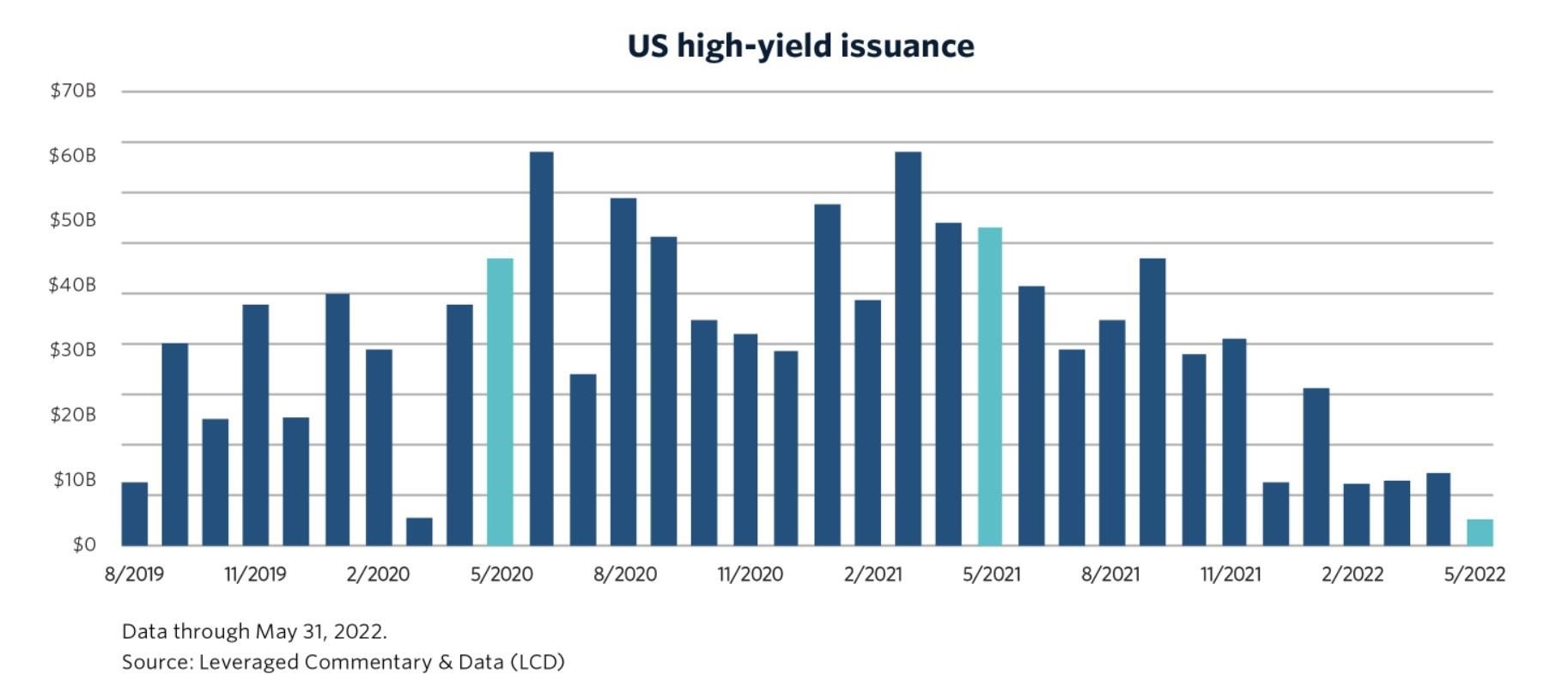

Speculative-Grade (“High Yield”) Bonds: A Riskier Debt Option

Speculative-grade bonds, also known as junk or high-yield bonds, provide borrowers with a way to increase leverage beyond what leveraged loans can accommodate. These bonds are typically unsecured and hold a junior position in the capital structure.

Senior vs. Subordinated Bonds: Understanding Priority Ranking

High-yield bonds can be senior or subordinated to other bonds within the capital structure. Senior bonds are repaid before subordinated bonds in a bankruptcy scenario.

Call Protection (Prepayment): Protecting Lender Interest

Call protection prevents borrowers from prepaying their bonds without penalty during a defined period. This helps protect lenders from losing interest payments.

Paid-in-Kind (PIK) Interest: An Alternative to Cash Interest

PIK interest allows borrowers to choose between paying cash interest or accruing interest that adds to the principal balance.

Mezzanine Debt: Bridging Debt and Equity

Mezzanine debt occupies the financing space between senior debt and equity. While technically encompassing second lien debt and senior and subordinated bonds, the term typically refers to debt securities with both debt and equity-like features.

Mezzanine Debt Characteristics: A Hybrid Approach

Mezzanine debt commonly involves:

- Purpose: Funding leveraged buyouts, often providing additional leverage beyond traditional loans and bonds.

- Investors: Hedge funds and mezzanine funds are primary investors, seeking higher returns than high-yield bonds.

- Unsecured: Typically unsecured with minimal covenants.

- Target Returns: Investors aim for blended returns of 10-20%.

- Private Transactions: Generally private transactions, limiting liquidity.

- Call Protection: Call protections vary, but often resemble high-yield bonds.

Equity Kicker: Boosting Mezzanine Investor Returns

Mezzanine investors often seek to enhance their returns with equity kickers, allowing them to participate in the borrower’s equity upside. This can be achieved through:

- Warrants: Options to purchase common stock at a predetermined price.

- Co-invest: The right to invest in equity alongside the controlling shareholder.

- Conversion Feature: The ability to convert debt or preferred stock into common stock.

A Debt Financing Cheat Sheet: A Summary of Key Features

This comprehensive cheat sheet provides a concise overview of the features commonly associated with debt structures used in leveraged finance.

Conclusion: Navigating the Complexities of Leveraged Finance

Leveraged finance represents a specialized area of corporate finance with its own unique dynamics, risks, and rewards. Understanding the key components, debt structures, and market trends within this field is essential for anyone involved in corporate transactions, particularly those involving highly leveraged companies.

Learn more about us at: javanet247

By leveraging this guide’s insights, you can navigate the complexities of leveraged finance with greater clarity and confidence.