Finace

How to Get Power of Attorney for Finances in Texas

A power of attorney for finances in Texas allows you to designate a trusted person, known as an "agent" or "attorney-in-fact", to manage your financial affairs on your behalf. This can be incredibly helpful in various situations, such as when you’re traveling, incapacitated, or simply need assistance with managing your money.

Understanding Power of Attorney in Texas

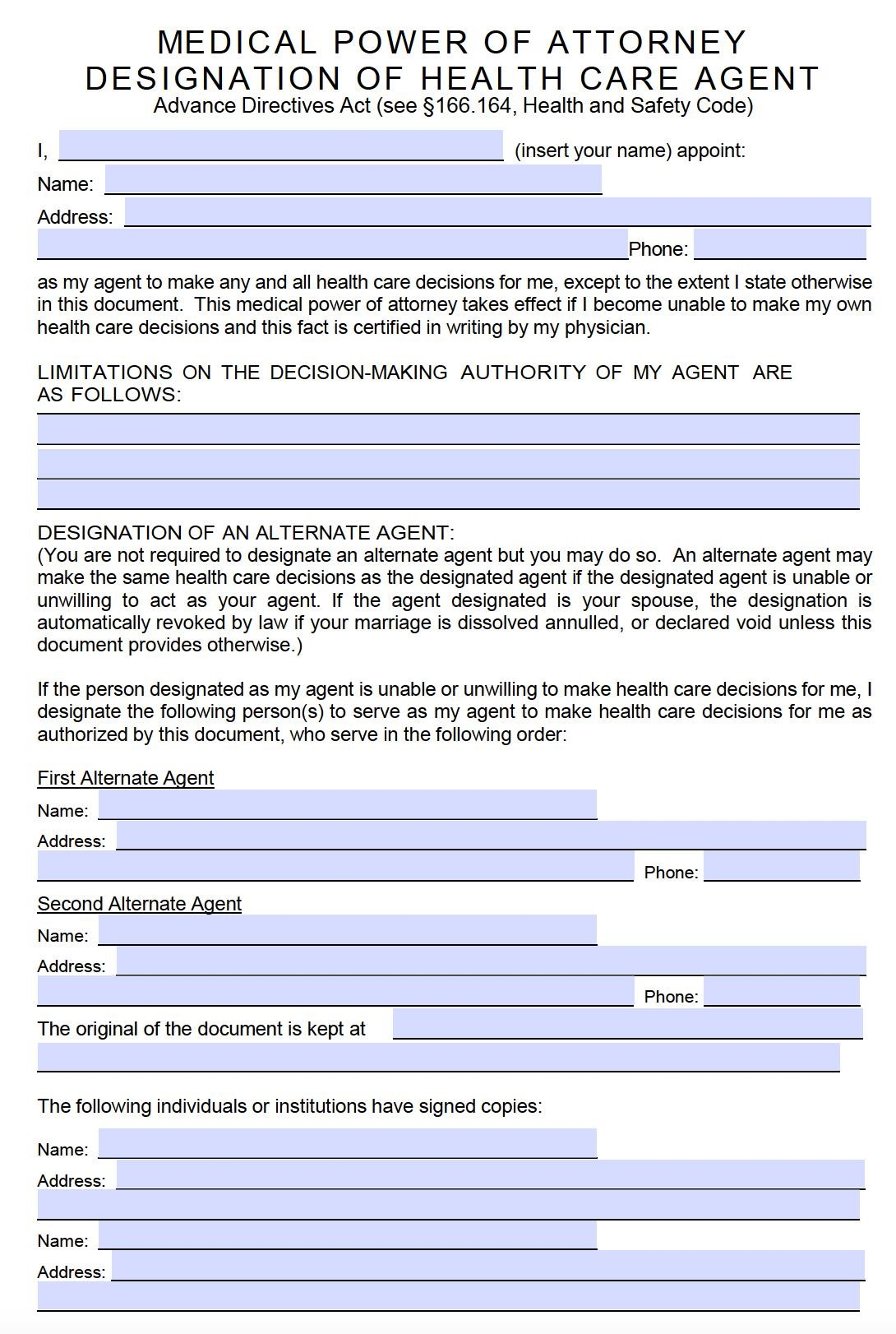

In Texas, there are different types of power of attorney documents, each serving a specific purpose:

Durable Power of Attorney

A durable power of attorney remains in effect even if you become incapacitated and unable to make decisions for yourself. It grants your agent broad authority over your financial matters, ensuring your finances are managed according to your wishes even if you’re unable to manage them personally.

Example: Imagine you fall ill and become unable to handle your bank accounts. With a durable power of attorney, your agent can access your funds and pay your bills, ensuring your financial responsibilities are met.

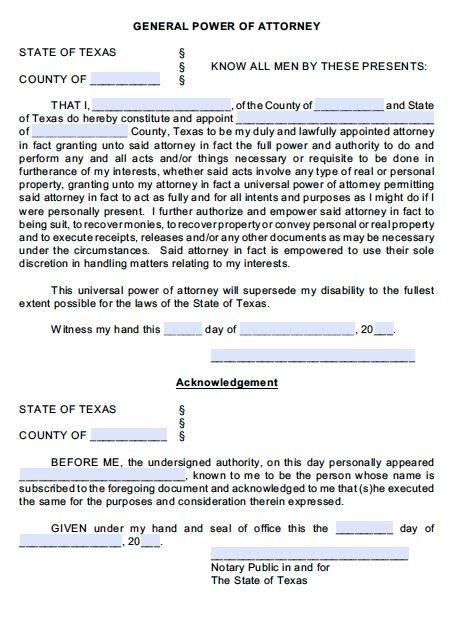

General Power of Attorney

A general power of attorney grants your agent authority over your finances but only remains in effect while you are mentally competent. If you become incapacitated, the document loses its validity.

Example: You might use a general power of attorney if you’re going on a long trip and need someone to handle your finances while you’re away.

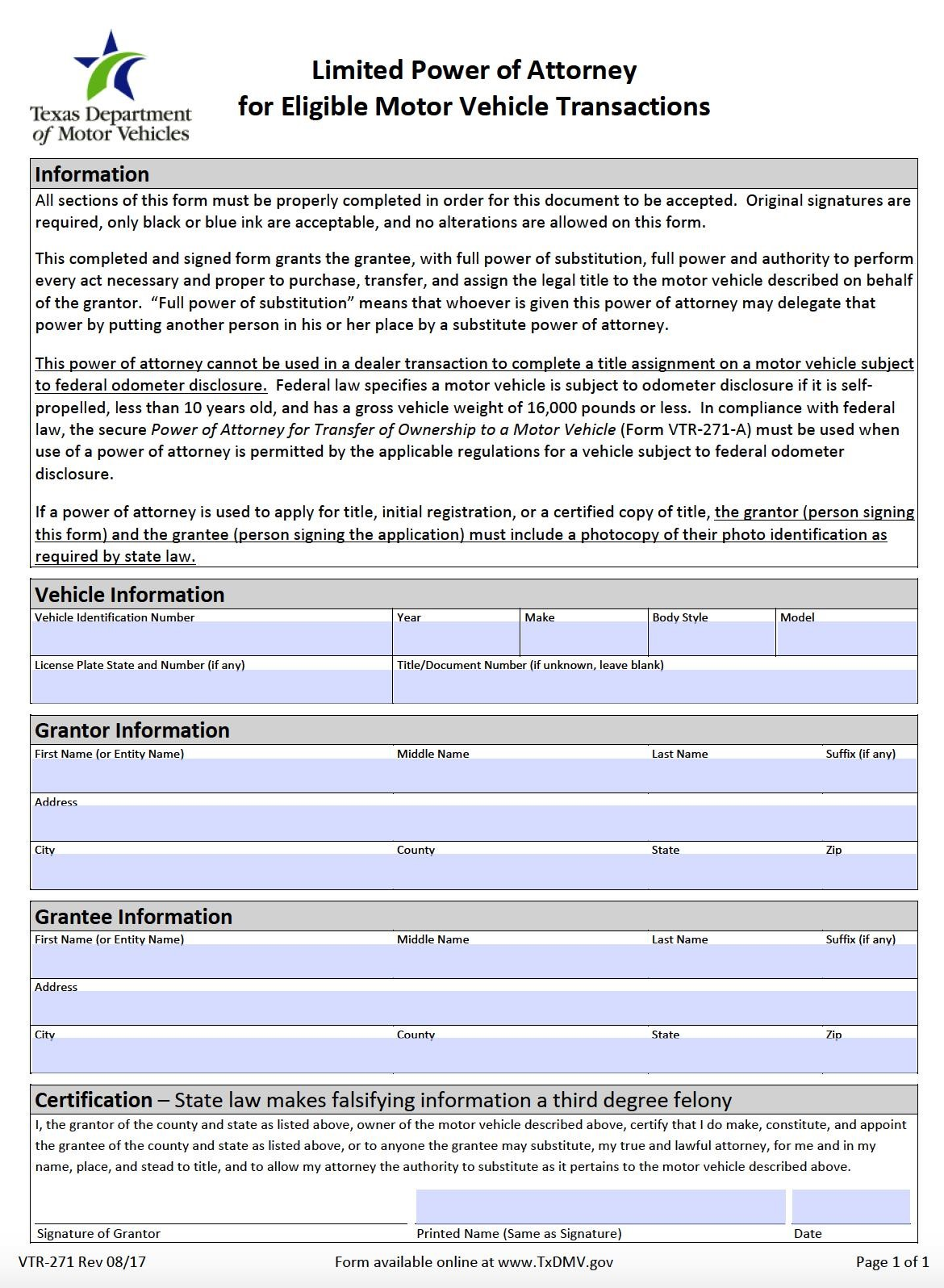

Limited Power of Attorney

A limited power of attorney gives your agent the authority to handle specific financial tasks. This document is often used for short-term purposes, such as buying a house or selling a vehicle.

Example: You could grant your agent limited power of attorney to manage your bank account while you’re recovering from surgery.

How to Get a Power of Attorney in Texas

To get a power of attorney for finances in Texas, you’ll need to:

- Choose Your Agent: Select a trusted person to act as your agent. They should be someone you feel comfortable with and confident in their ability to manage your finances responsibly.

- Complete the Form: You can obtain free Texas power of attorney forms online or from your lawyer. The form should include your name, your agent’s name, the type of power of attorney you’re granting, and your signature.

- Witness and Notary: In Texas, a power of attorney document must be witnessed by two credible witnesses, and notarized.

- Keep the Document Safe: Once the document is signed and notarized, keep it in a safe place, such as a safe deposit box or with your important documents.

Important Considerations

- Legal Advice: While free forms are available online, it’s always recommended to consult with a qualified attorney to ensure your power of attorney document is legally sound and tailored to your specific needs.

- Review and Update: It’s essential to review your power of attorney document regularly and update it if your circumstances change.

- Termination: You can terminate your power of attorney at any time. You should create a written revocation statement and give it to your agent, as well as your financial institutions, to inform them of the termination.

The Power of Attorney for Finances: A Vital Tool for Financial Security

Learn more about us at: javanet247

Having a power of attorney for finances in Texas can offer peace of mind, knowing that your finances are protected and managed according to your wishes. Remember to choose your agent carefully and ensure the document is legally sound to protect your financial well-being. By understanding the different types of power of attorney and taking the necessary steps to secure your document, you can empower yourself with a vital tool for managing your finances effectively.