Finace

Fort Sill Welcome Center Finance: Understanding Your Financial Options

Welcome to our comprehensive guide on Fort Sill’s Financial Readiness Program and the vital resources available to help you manage your finances and plan for your future. This article will delve into the program’s offerings, including financial education classes, budget counseling, and the crucial Army Emergency Relief (AER) program. We’ll also explore the Blended Retirement System (BRS) and its implications for your financial well-being.

Fort Sill Financial Readiness Program

The Fort Sill Financial Readiness Program is committed to empowering Soldiers and their families with the knowledge and tools they need to navigate their finances confidently. This program provides a range of services, including:

Financial Education & Training:

- Personal Financial Counseling: Schedule a one-on-one session with a financial counselor to discuss your individual needs and receive personalized advice.

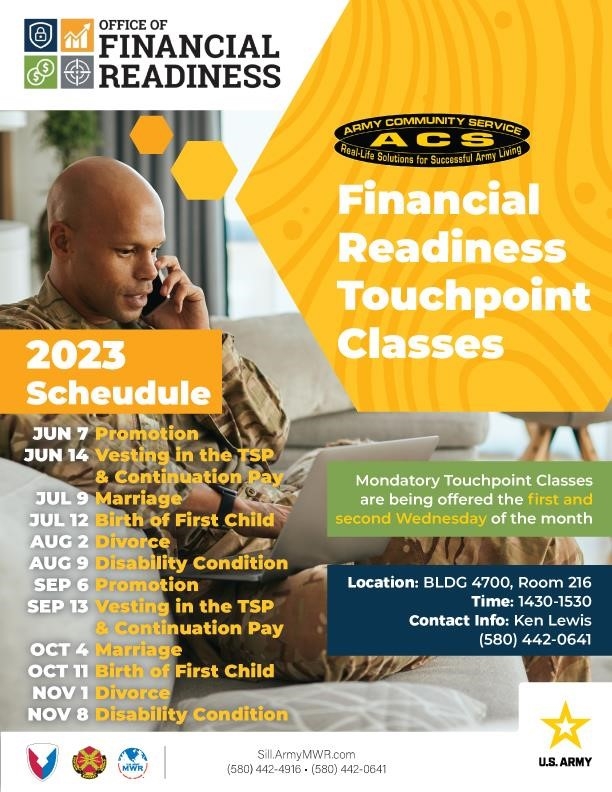

- Financial Management Classes: Access valuable classes covering topics like budgeting, debt management, saving, investing, and more.

Specialized Training:

- Relocation Financial Preparedness Training: Prepare for the financial challenges associated with moving. This mandatory class for E4s and below on their first PCS equips you with budget tools and strategies to reduce stress.

Contacting the Program:

For financial counseling, reach out to the ACS at +1 (580) 442-4916.

The Army Emergency Relief (AER) Program

AER stands as a vital lifeline for Active Duty and Retired Soldiers, offering financial assistance in times of need. As the Army’s own nonprofit organization, AER provides:

- Grants and Zero-Interest Loans: AER helps alleviate financial distress for Soldiers and their Families.

- Convenient Access: AER officers are conveniently located at installations worldwide.

- Supporting Millions: Since 1942, AER has provided crucial support to over 4 million Soldiers.

Learn More: Visit the Army Emergency Relief website at ArmyEmergencyRelief.org for detailed information on the program and how to apply.

AER Education Programs

AER offers a dedicated program to assist Army families with education expenses through three scholarships:

1. Stateside Spouse Education Assistance Program:

- Eligibility: Spouse or widow(er) of an active duty or retired Soldier residing in the United States.

- Requirements: Full-time student pursuing a first undergraduate degree.

- Exclusions: Active duty military personnel are not eligible.

2. Overseas Spouse Education Assistance Program:

- Eligibility: Spouse of an active duty Soldier assigned in Europe, Korea, Japan, or Okinawa.

- Requirements: Residing with the Soldier at the assigned location.

- Exclusions: Off-post students are not eligible.

- Study Options: Spouses can be part-time or full-time students.

3. Major General James Ursano Scholarship Fund for Dependent Children:

- Eligibility: Dependent children, stepchildren, or legally adopted children of Army Soldiers (active duty, retired, or deceased while on active duty or retired status).

- Additional Eligibility: Children of Grey Area Reservists/National Guard.

Scholarship Awarding:

- Financial Need: Scholarships are awarded based on demonstrated financial need, taking factors like income, assets, Family size, and special circumstances into consideration.

- Tuition Coverage: Scholarships can cover up to half the cost of tuition.

Access Application Resources:

Find application forms and instructions for all AER scholarships on the AER website at https://www.armyemergencyrelief.org/resources/.

The Blended Retirement System (BRS): Planning Your Future

The Blended Retirement System (BRS) presents new possibilities for financial planning during your military service. It’s essential to understand how BRS impacts your retirement savings and options:

- Key Considerations: Your eligibility, service length, and whether you’re Active, National Guard, or Reserve all play a role in determining the best BRS options for you.

- Inform Yourself: Get informed about the BRS and how it affects your retirement future by visiting the official BRS resources.

- Utilize Available Resources: Financial readiness programs like the one at Fort Sill provide guidance and support to help you make informed decisions about your financial future.

BRS Resources:

- YouTube Videos: Explore educational videos about BRS:

- Informative Flyers:

- Save on Movie Night and Walk the Red Carpet to Retirement Flyer

- Invest in Yourself, not the Coffee Shop Flyer

- Feast on More Savings in Retirement Flyer

Fort Sill Financial Readiness Program: Requesting Training

The Fort Sill Financial Readiness Program offers training sessions for your unit. To request training, follow these steps:

- Submit Training Request Form: Submit the request form at least two weeks in advance.

- Specify Details: Include reservation dates, times, locations, and desired training topics.

- ACS Financial Readiness Program Briefing/Class Request Form: Utilize this form to formally request training.

Conclusion: Taking Control of Your Finances

The Fort Sill Financial Readiness Program and the Army Emergency Relief program offer invaluable resources to help you navigate the financial aspects of military life. Take advantage of these programs to:

- Gain Financial Knowledge: Educate yourself about budgeting, saving, investing, and debt management.

- Seek Expert Guidance: Connect with financial counselors to address your individual financial needs and develop personalized strategies.

- Plan for the Future: Understand the Blended Retirement System and its implications for your long-term financial security.

Learn more about us at: javanet247

By actively managing your finances, taking advantage of available resources, and seeking professional guidance, you can achieve your financial goals and secure a prosperous future for yourself and your family.