Crypto

Best Anonymous Cryptocurrency Exchanges

Disclaimer: This is not a validation of cryptocurrency or any particular provider, service, or product. It should not be taken as advice to engage in trading or use any services. Please check our terms and conditions.

In today’s digital world, privacy is paramount. Cryptocurrency traders are increasingly seeking platforms that offer anonymity and security without compromising on features and usability. At Javanet247, we understand this need, and we’ve carefully compiled a list of the top 10 anonymous cryptocurrency exchanges, each with its unique strengths and offerings.

Our selection criteria are rigorous and multifaceted, focusing on aspects like privacy features, security measures, user interface, range of supported cryptocurrencies, and overall trading experience. Whether you’re a seasoned trader or just starting, this guide aims to provide valuable insights into the world of anonymous cryptocurrency trading.

Top 10 Anonymous Cryptocurrency Exchanges

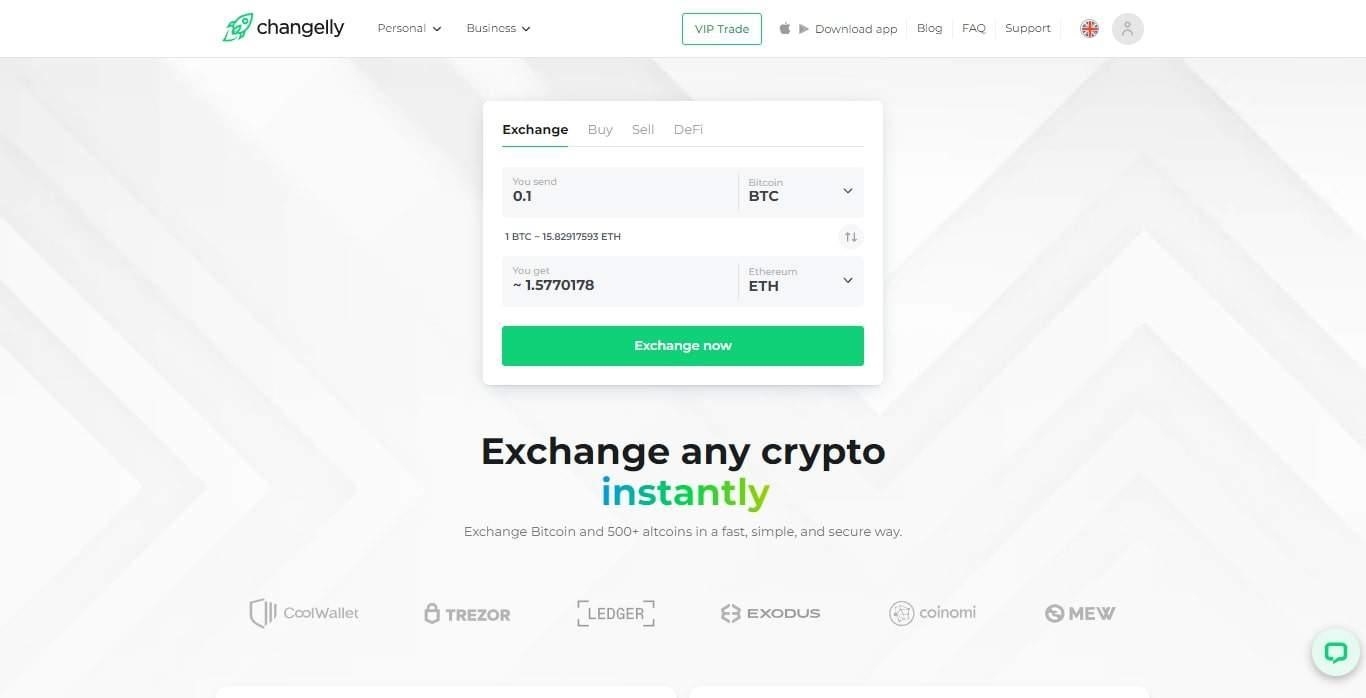

1. Changelly – Best for Instant Crypto Swaps

Trading Fees: 0.08% – 0.10%

Supported Fiat Currencies: USD, AUD, GBP, CAD, EUR, NZD + 100 others (some through third-party apps)

Why We Chose It:

Changelly offers direct crypto-to-crypto exchanges, making it ideal for quick and straightforward trades. Its wide range of supported cryptocurrencies and user-friendly interface make it a great choice for beginners. Plus, it integrates with multiple wallet services, allowing for seamless transactions directly from your personal wallet.

Changelly simplifies the trading process for those who want to avoid the complexities of standard exchange platforms.

Pros & Cons:

Pros:

- Wide selection of cryptocurrencies

- User-friendly interface

- No account creation needed for simple exchanges

- High limits for crypto exchanges

- 24/7 customer support

Cons:

- Higher fees compared to some other exchanges

- Exchange rates can be less competitive

- No advanced trading options

- No fiat currency trading pairs

- Mandatory account creation for fiat transactions

2. OKX – Best for Comprehensive DeFi Services

Crypto Head Rating: 3.62

Trading Fees: -0.005% – 0.10%

Supported Fiat Currencies: USD, AUD, GBP, CAD, EUR, NZD + 85 others (some through third-party apps)

Why We Chose It:

OKX is chosen for its impressive global presence and comprehensive offerings. It caters to both beginners and advanced traders with its diverse range of trading options.

OKX stands out for its DeFi integration, staking, and native token (OKB), which provides users with trading fee discounts and other benefits.

Pros & Cons:

Pros:

- Wide range of cryptocurrencies available

- Advanced trading features and interfaces

- Competitive trading fees

- Strong liquidity, facilitating large trades

Cons:

- Can be complex for beginners

- Has faced regulatory challenges in some countries

- No fiat currency support for certain services

- Customer support can be slow to respond

- Some users report technical glitches during peak trading times

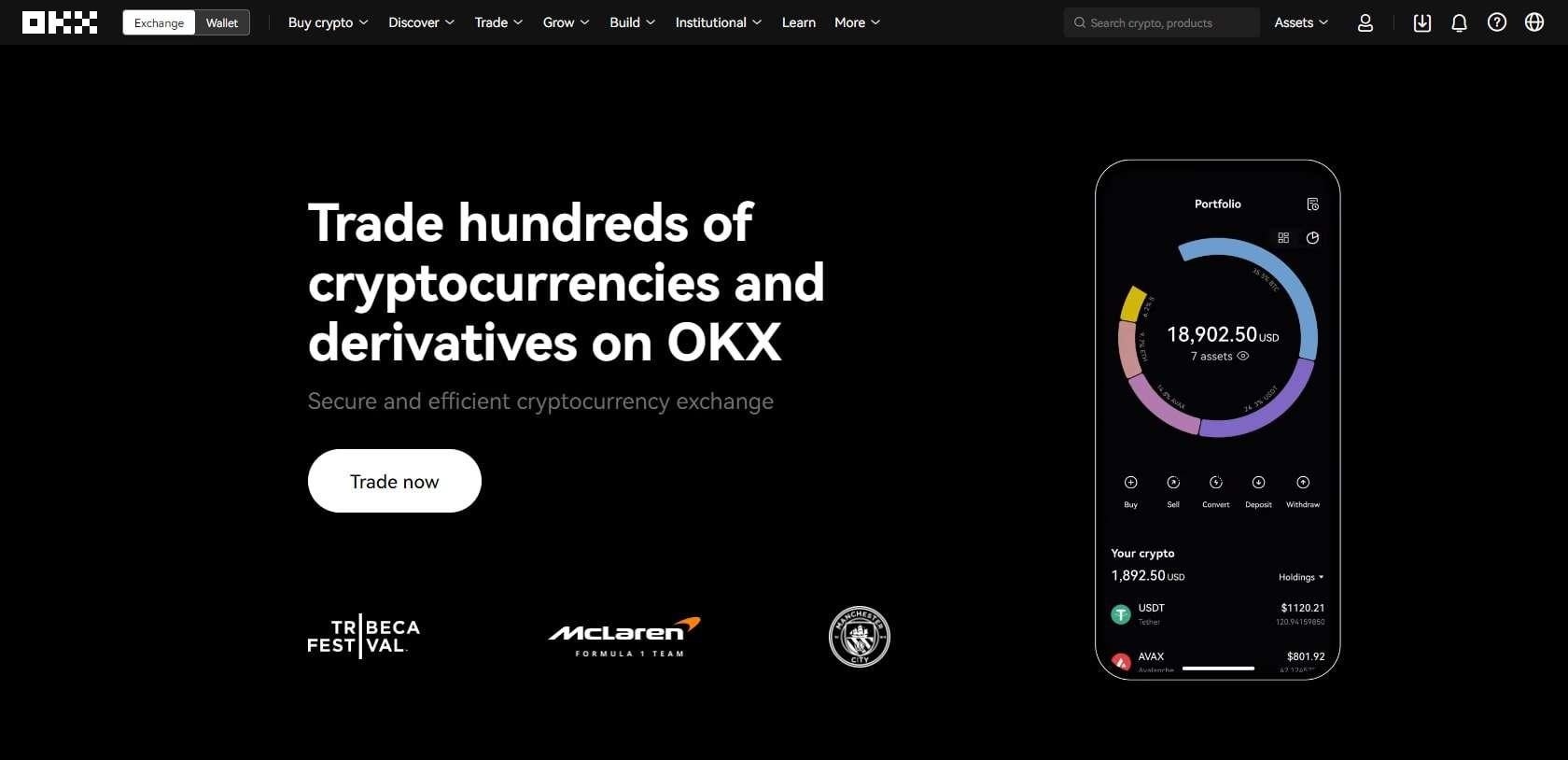

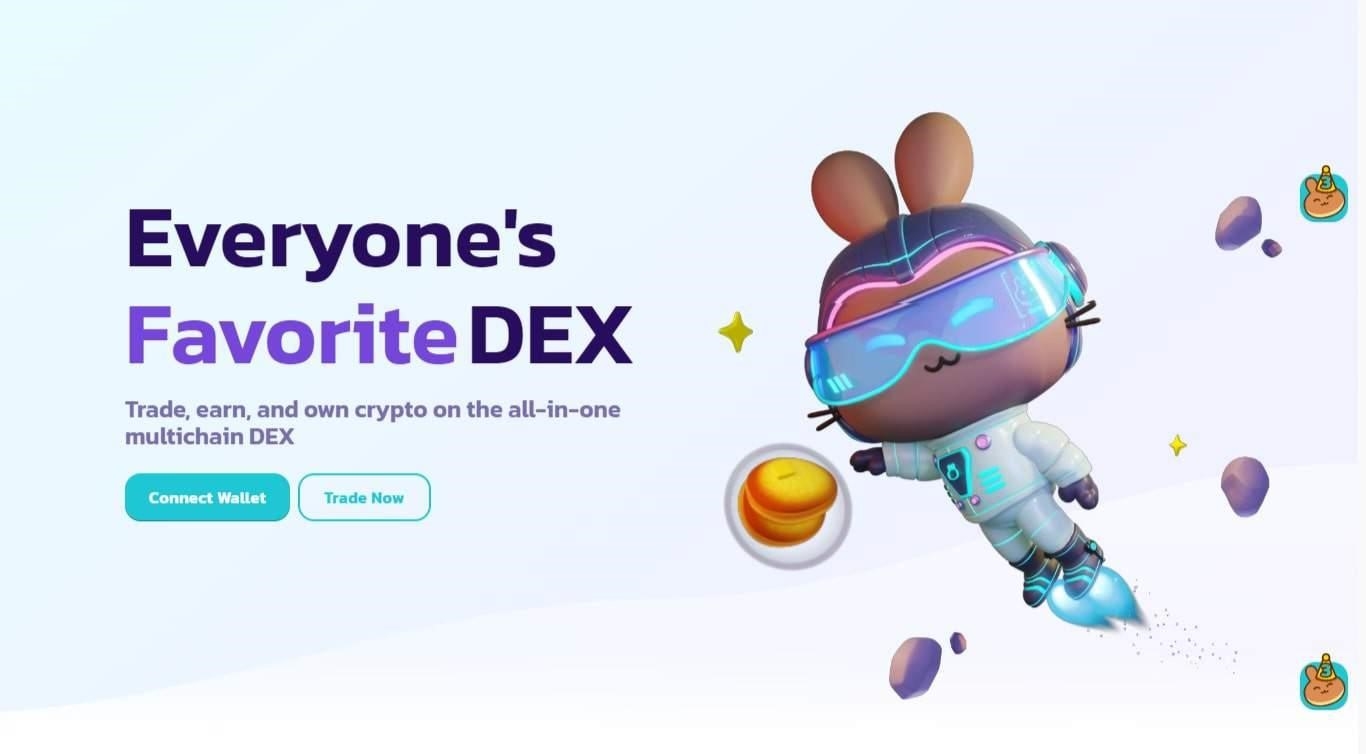

3. PancakeSwap – Best for Altcoin Variety

Crypto Head Rating: 3.22

Supported Fiat Currencies: USD, AUD, GBP, CAD, EUR + 7 others (some through third-party apps)

Why We Chose It:

PancakeSwap is a decentralized exchange (DEX) built on the Binance Smart Chain (BSC). It’s known for offering a different experience compared to traditional centralized exchanges, focusing on user autonomy and reduced transaction fees.

The platform stands out for its yield farming and liquidity pools, appealing to users interested in decentralized finance (DeFi) opportunities. Its user-friendly interface and integration of advanced trading features make it accessible to a broad audience.

Pros & Cons:

Pros:

- User-friendly interface

- Offers yield farming and staking options

- Low trading fees

- Large selection of tokens

- Community-driven governance

Cons:

- Primarily supports Binance Smart Chain tokens

- Smart contract risks

- Limited fiat currency support

- Limited customer support options

- Subject to impermanent loss in liquidity pools

4. Uniswap – Best for Decentralized Token Swaps

Crypto Head Rating: 2.90

Supported Fiat Currencies: USD, AUD, GBP, CAD, EUR, NZD + 29 others (only supports fiat currencies through third-party apps)

Why We Chose It:

Uniswap is a pioneering decentralized exchange (DEX) built on the Ethereum blockchain. It stands out for its automated liquidity protocol, revolutionizing the way users trade cryptocurrencies without a traditional centralized intermediary.

The platform is highly regarded for its permissionless nature, allowing anyone to list tokens and provide liquidity. This openness has made Uniswap a hub for a wide variety of ERC-20 tokens, attracting a diverse user base.

Pros & Cons:

Pros:

- Decentralized and non-custodial

- Wide variety of tokens available for trading

- Automated market maker (AMM) system provides liquidity

- Open-source platform with a strong developer community

- Earn fees by providing liquidity

Cons:

- Susceptible to impermanent loss for liquidity providers

- No fiat on-ramps; crypto-to-crypto trades only

- Higher risk of slippage for large orders

- Lack of customer support compared to centralized exchanges

- Smart contract vulnerabilities could lead to loss of funds

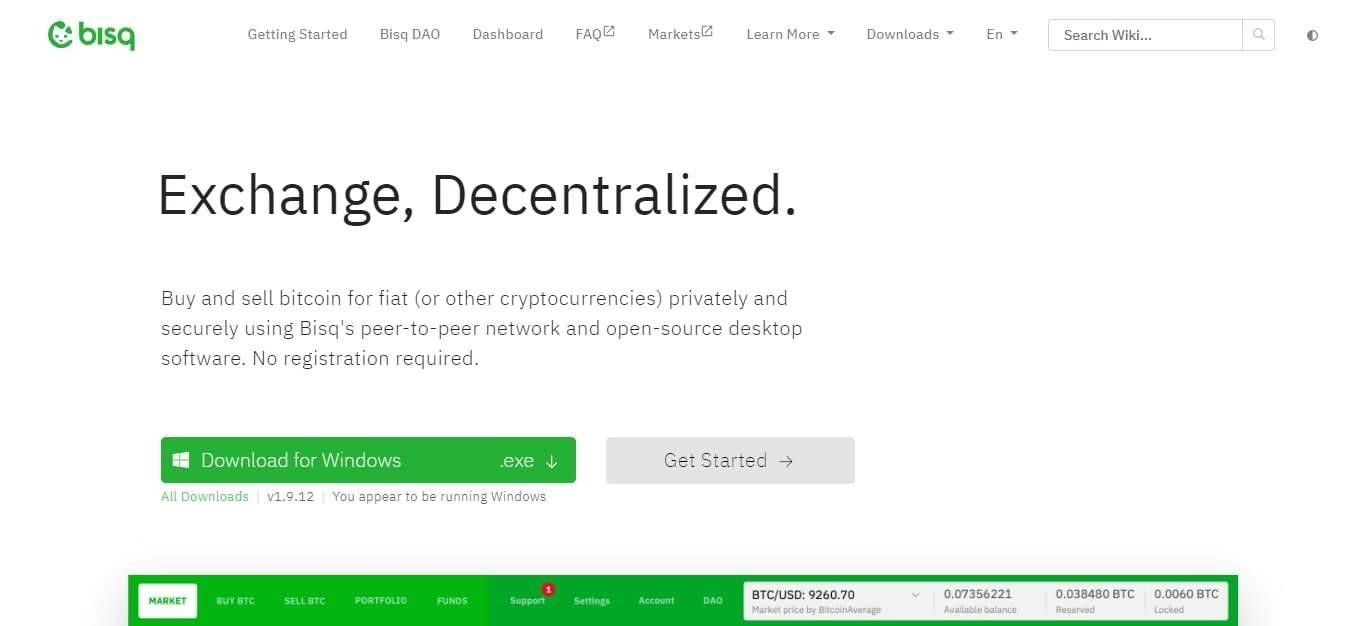

5. Bisq – Best for Decentralised and Private Trading

Trading Fees: 0.15% – 1.15%

Supported Fiat Currencies: USD, AUD, GBP, CAD, EUR, NZD + 10 others (some through third-party apps)

Why We Chose It:

Bisq is a fully decentralized, peer-to-peer (P2P) exchange that operates without a central authority. This open-source platform appeals to users who prioritize privacy and security, offering a way to exchange cryptocurrencies in a trustless environment.

Its focus on user privacy, with no need for identity verification, makes Bisq a standout choice for those seeking anonymity in their transactions. The platform supports a variety of payment methods, enhancing its accessibility and convenience for users globally.

Pros & Cons:

Pros:

- Decentralized and peer-to-peer

- Enhanced privacy and security features

- Supports a wide range of fiat currencies

- No need for KYC verification

- Open-source software with community-driven development

Cons:

- Not as user-friendly as some centralized exchanges

- Limited payment methods compared to larger exchanges

- Lower liquidity can lead to slower trades and potentially higher spreads

- Dispute resolution can be more complex due to peer-to-peer nature

- Limited cryptocurrency selection compared to larger exchanges

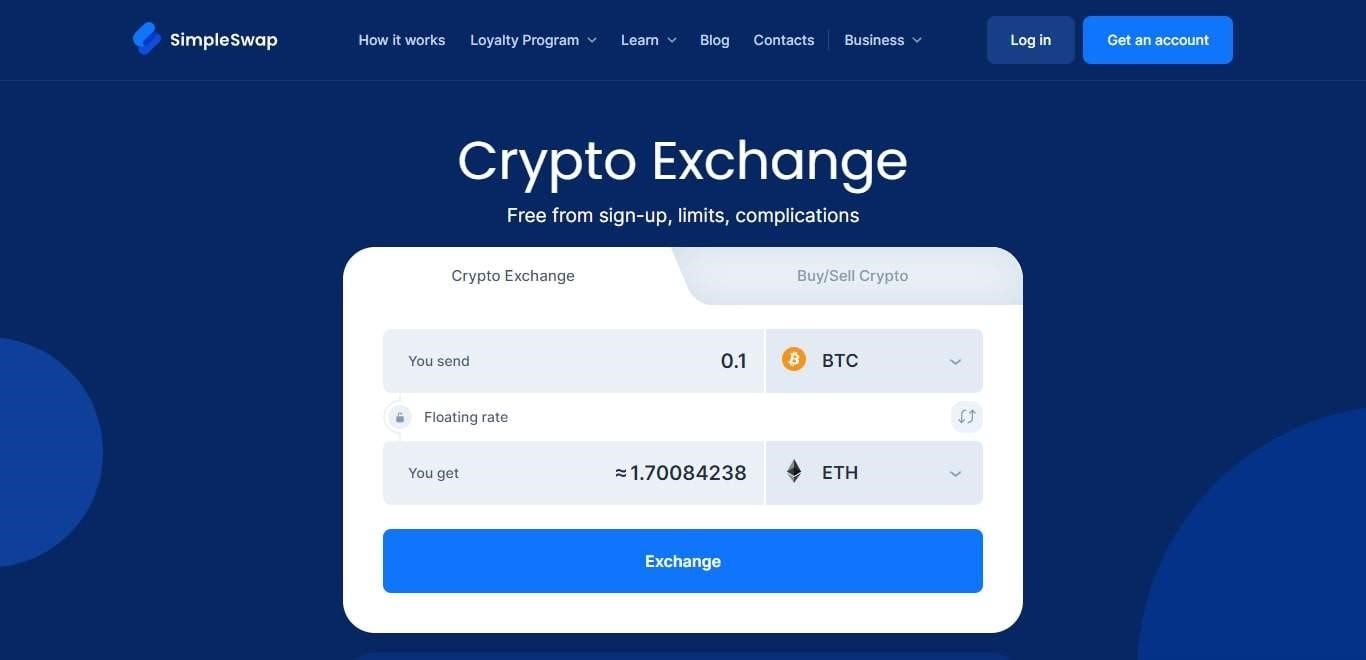

6. SimpleSwap – Best for User-Friendly Interface

Supported Fiat Currencies: USD, AUD, GBP, CAD, EUR, NZD + 36 others (only supports fiat currencies through third-party apps)

Why We Chose It:

SimpleSwap is an instant cryptocurrency exchange that offers a streamlined and user-friendly platform for quick and hassle-free crypto swaps.

The platform stands out for not requiring user registration or account creation, making it highly accessible for those seeking quick transactions with minimal setup. SimpleSwap’s support for a wide range of cryptocurrencies, including major coins and altcoins, caters to a diverse range of user preferences.

Pros & Cons:

Pros:

- User-friendly interface

- Supports a wide range of cryptocurrencies

- No need to register an account

- Offers both fixed and floating exchange rates

- Available globally

Cons:

- No fiat currency support

- Lack of advanced trading features

- No wallet service offered

- Customer support can be slow

- Some users report high exchange rate spreads

7. dYdX – Best for Trading Options

Crypto Head Rating: 3.09

Trading Fees: 0.02% – 0.04%

Supported Fiat Currencies: USD, AUD, GBP, CAD, EUR, NZD + 26 others (only supports fiat currencies through third-party apps)

Why We Chose It:

dYdX is a decentralized platform offering advanced trading features. Built on the Ethereum blockchain, it caters to traders looking for a decentralized solution to access more complex trading options.

The platform is notable for its non-custodial structure, ensuring that users maintain full control over their funds. This aspect, combined with the ability to execute advanced trading strategies in a decentralized environment, makes dYdX particularly appealing to experienced traders in the DeFi space.

Pros & Cons:

Pros:

- Decentralized platform that reduces the risk of central points of failure

- Offers high leverage on trades, up to 20x

- No gas fees for trading as it operates on a layer 2 solution

- Smart contracts are open-source, enhancing transparency

- Users maintain control of their funds, promoting security

Cons:

- Limited to crypto-to-crypto trading

- A smaller selection of trading pairs compared to some other exchanges

- Requires a certain level of expertise to navigate and use effectively

- Potentially lower liquidity than larger, centralized exchanges

- The platform’s relatively narrow focus might not suit all traders

8. KuCoin – Best for User-Friendly Trading Experience

Crypto Head Rating: 3.08

Trading Fees: 0.025% – 0.1%

Supported Fiat Currencies: USD, AUD, GBP, CAD, EUR, NZD + 50 others (some through third-party apps)

Why We Chose It:

Please note: In March 2024, the US Justice Department charged KuCoin and two founders Chun Gan and Ke Tang alleging that they "affirmatively attempted to conceal the existence of KuCoin’s US customers in order to make it appear as if KuCoin was exempt from US AML and KYC requirements." We would suggest being cautious with using KuCoin at this time.

KuCoin is recognized for its extensive range of supported cryptocurrencies and user-friendly platform, making it a popular choice among global traders.

The exchange is particularly noted for its unique offerings like the KuCoin Shares (KCS) token, which provides users with a stake in the platform’s success. Additionally, its integration of advanced trading features and commitment to user security make it a comprehensive and trustworthy platform in the crypto exchange market.

Pros & Cons:

Pros:

- Wide range of cryptocurrencies available

- Competitive trading fees

- Advanced charting and trading tools

- User-friendly interface

- Staking and lending services for additional earnings

Cons:

- History of security incidents

- Customer support can be slow to respond

- No built-in fiat withdrawal options

- Complex interface for beginners

- Limited regulatory oversight in some regions

9. Bybit – Best for Advanced User Interface

Crypto Head Rating: 3.25

Trading Fees: -0.0050% – 0.1000%

Supported Fiat Currencies: USD, AUD, GBP, CAD, EUR, NZD + 160 others (some through third-party apps)

Why We Chose It:

Bybit is known for its rapid growth and strong position in the cryptocurrency exchange market. It appeals to traders looking for high liquidity and advanced trading features. The platform is known for its intuitive user interface, making it accessible to a wide range of users, from beginners to professionals.

The exchange stands out for its high-speed trade matching engine and strong focus on customer service, ensuring a smooth and responsive trading experience. Bybit’s commitment to providing a stable and reliable trading environment makes it a preferred choice for traders globally.

Pros & Cons:

Pros:

- Advanced trading features

- Competitive trading fees

- No KYC for basic account functions

- High liquidity

- Supports a variety of cryptocurrencies

Cons:

- High risk for inexperienced users

- Limited educational resources for beginners

- No fiat deposits or withdrawals

- Customer support can be slow

10. Pionex – Best for Automated Trading Bots

Crypto Head Rating: 4.08

Supported Fiat Currencies: USD, AUD, GBP, CAD, EUR, NZD + 84 others (some through third-party apps)

Why We Chose It:

Pionex is one of the first to offer built-in trading bots, allowing users to automate their trades without needing external software.

The platform stands out for its user-friendly interface and the variety of in-built trading bots, such as the Grid Trading Bot and the Arbitrage Bot, which simplify complex trading tactics. Pionex is also notable for its low trading fees and liquidity aggregation, pooling liquidity from multiple sources to provide users with better trading opportunities.

Pros & Cons:

Pros:

- Offers built-in trading bots for automated trading

- Low trading fees compared to many other exchanges

- Supports a wide range of cryptocurrencies for trading

- User interface is relatively easy to navigate

- No fees for depositing cryptocurrencies

Cons:

- Limited information on the team and company background

- Customer support can be slow to respond

- Fiat deposits and withdrawals aren’t supported

- The platform may have a learning curve for beginners using bots

- Limited advanced trading features for professional traders

How to Choose the Best Crypto Exchange

Selecting the right cryptocurrency exchange is just as crucial as the trades you make. Here are some vital aspects to consider when picking a cryptocurrency exchange:

- Anonymity and Privacy: Look for exchanges that do not require extensive personal information or identity verification.

- Security Measures: Investigate security protocols like two-factor authentication (2FA), cold storage options, encryption methods, and history of security breaches.

- Supported Cryptocurrencies: Make sure the exchange supports the cryptocurrencies you want to trade.

- Fees Structure: Understand the deposit, withdrawal, and trading fees.

- User Interface and Ease of Use: Choose an exchange with a user-friendly interface that matches your experience level.

- Liquidity: High liquidity allows for quicker and more accurate trade execution.

- Regulatory Compliance: Consider the degree of regulatory compliance.

- Customer Support: Choose a platform with a reputation for responsive support.

- Geographical Restrictions: Ensure the exchange you choose operates fully in your country.

- Additional Features: Consider features like staking, margin trading, lending, or integration with wallets and third-party applications.

Remember, no single exchange will be the best for every trader.

Final Thoughts

The world of crypto trading offers a diverse landscape of platforms, each with its unique features and benefits. Our guide aims to illuminate the key aspects of these exchanges, providing you with the insights needed to make an informed choice tailored to your trading needs.

It’s important to remember that the choice of an exchange is a personal one, heavily influenced by individual trading styles, risk tolerance, and specific needs regarding privacy, security, and functionality.

Learn more about us at: javanet247

We encourage traders to use this guide as a starting point in their journey to find the perfect cryptocurrency exchange. Remember the key factors such as anonymity, security measures, supported cryptocurrencies, fee structures, and user interface when making your decision. The crypto world constantly evolves, and staying informed and adaptable is key to successful trading.