Finace

What Is Creative Financing?

This article delves into creative financing, which is a strategy real estate investors can use to purchase properties even without a traditional mortgage. We’ll explore the common challenges investors face and 11 unique methods to acquire real estate with alternative financing.

Understanding the Process of Traditional Financing

Traditionally, financing a real estate purchase involves a straightforward process with four key players: the seller, the buyer, the lender, and the closing agent. The buyer and seller sign a purchase agreement and the buyer applies for a mortgage. The lender approves the loan and the closing agent manages the final transaction, where the buyer uses the loan proceeds to pay the seller. This process culminates in the transfer of the deed to the buyer, marking the completion of the traditional financing process.

11 Creative Financing Strategies for Real Estate Investors

Creative financing offers a unique approach to real estate acquisition, providing investors with diverse options beyond traditional mortgages. These methods can help investors secure better loan terms, minimize out-of-pocket expenses, and navigate the complexities of the real estate market.

1. Cash-Out Refinance: Unlocking Equity for Investment

A cash-out refinance allows investors to tap into the equity of their existing home. It involves borrowing an amount based on the home’s value and using the excess funds for real estate investment. This strategy offers a financial boost with potentially lower interest rates compared to other financing options. However, it’s crucial to consider the risks, including a longer mortgage term and increased loan-to-value ratio.

2. Home Equity Line of Credit (HELOC): Flexibility for Property Enhancements

A HELOC provides a line of credit secured by your home’s equity, offering flexibility for various needs, such as property renovations or improvements. Unlike a cash-out refinance, a HELOC doesn’t replace the original mortgage, allowing you to draw funds as needed within a specified draw period.

3. Personal Loan: Unsecured Financing for Real Estate Ventures

Personal loans can be a valuable financing option for real estate investors with good credit and limited home equity. While they lack the tax benefits of refinancing or HELOCs, personal loans offer shorter repayment terms and can be obtained without collateral.

4. Seller Financing: Leveraging Other People’s Money

Seller financing, also known as "seller carryback," involves the seller providing the loan for the property purchase. This strategy minimizes the investor’s personal financial commitment and allows them to leverage other people’s money for the investment. It is particularly beneficial when dealing with sellers who own their properties outright and are willing to receive long-term passive income instead of immediate cash.

5. Lease Option: A Path to Homeownership

A lease option contract allows an investor to lease a property with the option to purchase it at the end of the lease term. This arrangement is beneficial when the investor is not ready or able to make a direct purchase but wishes to build equity through rent payments.

6. Self-Directed IRA: Enhancing Retirement Savings with Real Estate

Investors with retirement savings can consider a self-directed IRA, which offers greater control over investments and various tax benefits. This strategy allows investors to utilize retirement funds to acquire real estate, but it’s important to understand the risks and ensure a robust system for deal analysis and risk assessment.

7. Hard Money: Accessing Real Estate Financing with Speed

Hard money loans, often obtained from private businesses or individuals, provide quick access to funding for real estate investments. These loans have less stringent requirements than traditional mortgages, but they come with higher interest rates and shorter terms. Hard money lenders focus on the project’s potential and after-repair value (ARV) rather than credit scores, making them suitable for short-term financing.

8. Private Money: Personalized Real Estate Financing

Private money loans involve borrowing from individuals with personal connections to the borrower, such as friends, family, or colleagues. This approach offers the potential for flexible loan terms and a less formal relationship. However, it’s crucial to establish clear communication and trust with the private lender to ensure a smooth and mutually beneficial transaction.

9. FHA Loans: Ideal for First-Time Buyers

FHA loans, backed by the Federal Housing Administration, are specifically designed for first-time homebuyers with credit scores of 580 or above. These loans offer favorable terms, including lower down payment requirements. However, they also come with upfront and annual insurance premiums.

10. Crowdfunding: Harnessing the Power of the Public

Crowdfunding platforms allow investors to raise funds from the public. Real estate-specific platforms connect investors with potential backers who can contribute to a project. Crowdfunding requires effective communication and storytelling to attract backers and successfully fund the investment.

11. Cross Collateral: Leveraging Existing Property for Financing

Cross-collateralization involves using the equity in an existing property as collateral for a loan on a new property. This strategy eliminates the need for a down payment on the new property and can provide access to additional financing. However, it’s essential to carefully assess the risks and ensure the arrangement aligns with your investment goals.

Creative Financing Strategies: Final Words

Creative financing options provide investors with alternatives to traditional mortgages. They can unlock opportunities, secure better loan terms, and minimize out-of-pocket expenses. By exploring these strategies and choosing the best option for each project, real estate investors can navigate the market successfully and achieve their investment goals.

Learn more about us at: javanet247

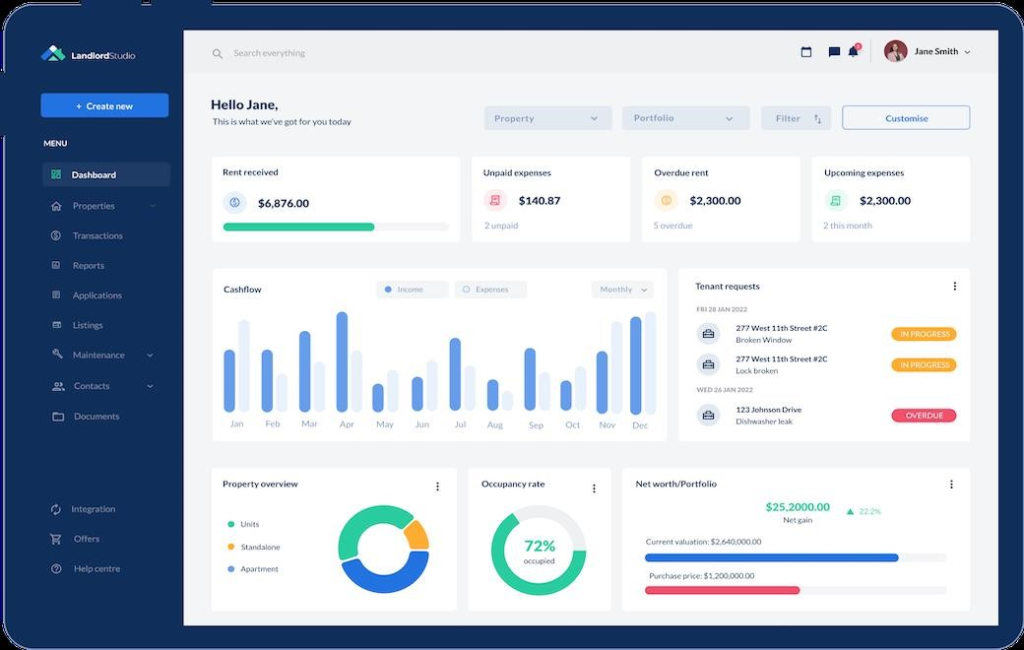

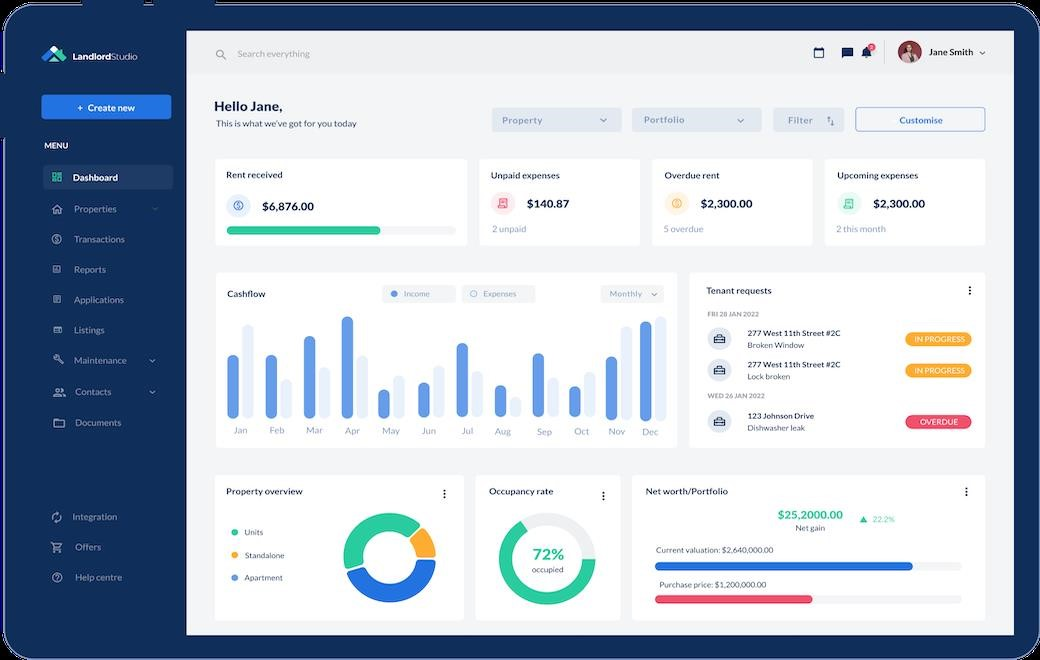

Remember, when you’re financing any investment, make sure you have a reliable system for tracking your income and expenses. It is crucial for building a solid financial foundation for your real estate ventures.